Industry News

Court Clarifies What Qualifies as a "Basket Provision"

TweetFeb. 2, 2024

By:

Hannah B. Kreinik

The Harmonized Tariff is a notoriously difficult document to navigate. It currently consists of almost 4500 pages and is intended to classify every article in the world. That’s a lot of articles. One way it does this is by using so-called “basket provisions” intended to cover articles not perfectly described by more specific provisions. However, basket provisions are generally disfavored in classification and in the application of some U.S. trade programs. Which raises the question of what, precisely, is a basket provision.

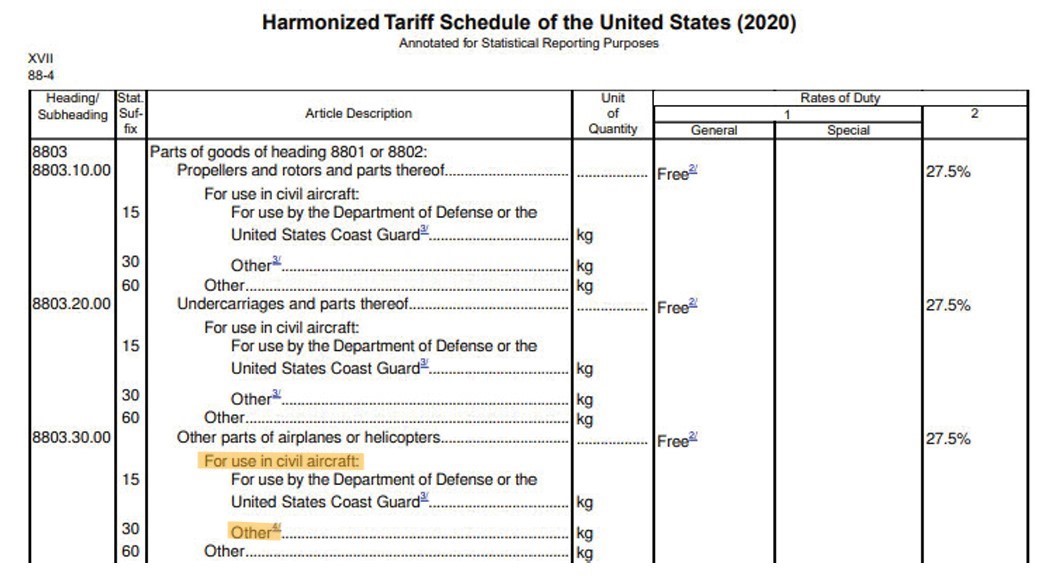

In Spirit Aerospace v. United States the Court of International Trade addressed that precise question in the context of drawback. The question at hand was whether the “prefatory language” not associated with a specific tariff number removed the provision from the “basket” category or the fact that the provision associated with a tariff number was “other” made it a basket provision. The provision is highlighted below.

Spirit originally entered the goods at issue in 2018 under HTS provision, 8803.30.0030. In 2020, Spirit sought substituted unused drawback for the goods. However, 19 U.S.C. §1313(j)(5) denies substituted unused drawback for articles classified on the 8th-digit level of the HTS with the description “other,” unless the imported merchandise and the exported/destroyed merchandise is classified under the same 10th-digit statistical reporting number, and that number does not have the description of “other.” Customs rejected the drawback claim as violating this provision.

Spirit argued that this was not a “basket provision” because the words “for use in civil aircraft,” although not directly associated with a tariff number, made the provision specific. Instead, 8803.30.0060 would be true “basket provision.”

The court did not agree. Instead the court found that the plain meaning of §1313(j)(5)’s language, specifically, the phrase, “for that article description” implies that the 10th level digit and its adjacent language should be interpreted together. As such, the 10th digit level did not begin with the prefatory “For use in civil aircraft,” but with “other,” and the exception under §1313(j)(5) was inapplicable. Thus, the court upheld CBP’s denial of Spirit’s substituted unused drawback claim.

While this case is directly relevant only to 1313(j)(5) drawback claims, the clarification that provisions contained under prefatory language may still be basket provisions may have implications in various Customs enforcement scenarios. Customs has long looked skeptically at what it considers “excessive” use of basket provisions by importers. This decision may open a new universe of provisions for Customs to scrutinize. Importers using these provisions would be well served by a classification review to ensure they are correct.

The attorneys at Barnes, Richardson & Colburn can help you with tariff classification issues, as well as drawback claims.