Industry News

CBP Clarifies: In-Transit Tariff Exemption Applies Only to Vessel Shipments

TweetApr. 30, 2025

By:

Marvin E. McPherson

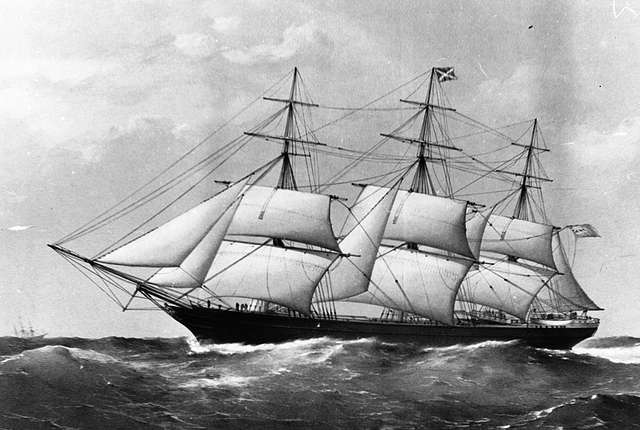

In an FAQ update issued April 30, U.S. Customs and Border Protection (CBP) clarified that in-transit exemptions from reciprocal tariffs, effective for goods in transit as of April 5 or April 9, apply to goods transported only by vessel.

The CBP updated guidance states that the in-transit provisions “do not extend to other modes of transportation such as air, rail, or truck.” Additionally, shipments that begin by vessel but arrive in the United States by another mode of transport (e.g., via transloading) are not eligible for the exemption.

CBP cites statutory definitions in 19 U.S.C. § 1401 and 19 CFR § 4.0, which define a “vessel” as any watercraft or contrivance used or capable of being used for transportation on water, excluding aircraft.

CBP advises importers and filers that any entries transported by non-vessel modes but filed under tariff provision HTS 9903.01.28 should be corrected immediately. Importers should submit a post summary correction (PSC) to correct the entry summary if HTS 9903.01.28 was used in error.

For questions or assistance in determining eligibility under these in-transit provisions, please contact any attorney at Barnes Richardson and Colburn.