Industry News

New Round of Global Tariffs: A Round Up

TweetAug. 1, 2025

By:

Pietro N. Bianchi

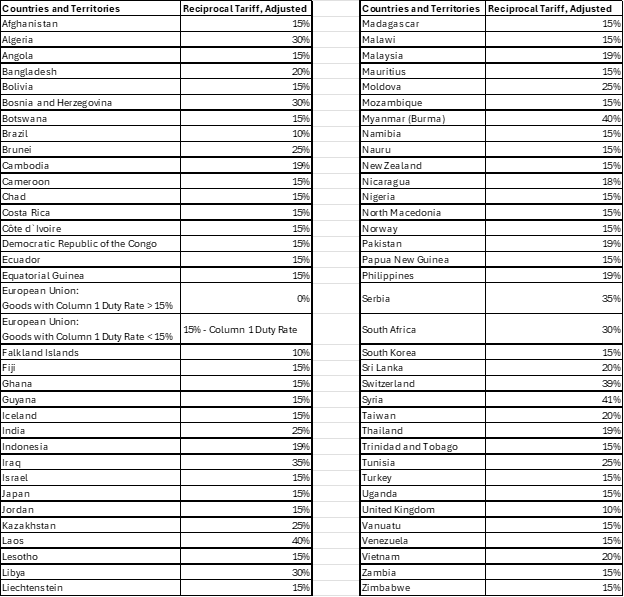

On July 31 President Trump signed an Executive Order adjusting the so-called “reciprocal” tariff rates announced on April, 2, 2025. The adjusted tariff rates, ranging from 10-41 percent, will take effect on August 7, 2025. Goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before August 7, 2025 and entered before October 5, 2025 are exempt from the adjusted rates. Countries not listed below are subject to a 10 percent reciprocal rate:

Trump imposed these tariffs under International Emergency Economic Powers Act of 1977 (“IEEPA”) after declaring the trade deficit of the U.S. to be a national emergency. The Executive Order adjusting the IEEPA trade deficit tariff rates came one day shy of the scheduled August 1, 2025, resumption of the heightened “reciprocal” rates, which were suspended in mid-April after political and economic turmoil. While the adjusted rates are often significantly higher than the 10 percent universal rate in effect since April, many of the adjusted rates are much lower than the previously suspended “reciprocal” rates.

During this time, the Trump administration has been engaged in trade talks with various trading partners that have yielded mixed results. Trade talks resulted in a 15 percent rate on goods from the European Union, Japan, and South Korea. In exchange, these countries agreed to a variety of terms including investment commitments and promises to purchase American goods such as natural gas, aerospace products, and military equipment. This 15 percent rate will only apply to E.U. goods if the existing most favored nation (“normal”) tariff is less than 15 percent and the IEEPA tariff will be 15 percent minus the normal tariff rate. However, goods from Japan and South Korea, like all other countries, will be assessed the IEEPA tariff on top of any existing normal tariff rate. It would be a disservice to omit that Japan and the E.U. are among a number of countries that have announced different interpretations of the trade talks.

The Trump Administration appears to be using the IEEPA tariffs as a carrot or stick for various U.S. agendas rather than as a tool to address trade deficits. Pakistan’s rate was adjusted from 29 to 19 percent after trade talks concerning an oil reserve pact, the details of which have not been announced. India’s adjusted rate of 27 percent came as somewhat of a surprise. Trump had recently posted that goods from India would face a 25 percent tariff plus a penalty for buying Russian oil. The apparent penalty of 2 percent seems out of place with the significant tariffs imposed this year. Brazil’s IEEPA trade deficit tariff rate will remain at 10 percent. However, this will be in addition to a separate 40 percent IEEPA tariff recently imposed on Brazilian goods for numerous non-trade reasons.

Notable countries missing from the Executive Order’s list include China, Canada, and Mexico. China’s reaction to the Trump Administration’s previous trade policies resulted in a string of retaliatory measures on both sides. The trade war truce reached in May resulted in a suspension of the “reciprocal” IEEPA trade deficit tariff rate on Chinese goods until August 12, 2025. Goods from Canada and Mexico have been subject to a different set of IEEPA tariffs, which, instead of targeting the trade deficit, address the flow of fentanyl and other illicit drugs across the northern and southern border of the U.S. In return for agreeing to eliminate non-tariff trade barriers, Trump posted that there would be no change in the tariff treatment of Mexican goods for 90 days. On the other hand, the IEEPA fentanyl tariffs on Canadian goods were increased from 25 to 35 percent due to “continued inaction and retaliation,” which may include backing statehood for Palestine.

To mitigate the appeal of transshipment, which has been a significant problem with the application of trade remedies similar to IEEPA tariffs, Trump ordered that transshipped goods will be subject to a 40 percent rate instead of the adjusted rate. Transshipment is a scheme to avoid tariffs or other regulations that involves purposefully misrepresenting the country of origin of goods and may involve transiting shipments through a third country while performing no or minimal operations there. If you have questions about IEEPA tariffs or other trade remedies do not hesitate to contact an attorney at Barnes Richardson, & Colburn LLP.