Industry News

Trump Announces 25% Tariff on Passenger Vehicles, Light Trucks, and Auto Parts

TweetApr. 2, 2025

By:

Austin J. Eighan

On April 2 an Executive Order (EO) was published ordering 25% tariffs on passenger vehicles, light trucks, and automobile parts under Section 232 of the Trade Expansion Act of 1962. The tariffs will be assessed in addition to any other duties, fees or exactions applicable to the entry.

In line with the March 26 Proclamation (please see our previous discussion here), the Federal Register's publication of the EO includes in Annex I a detailed breakdown of how the tariffs will be implemented and which tariff classifications will be impacted. Although no expiration date was given, the President may reduce, modify, or terminate the remedy at his discretion.

Passenger Vehicles and Light Trucks

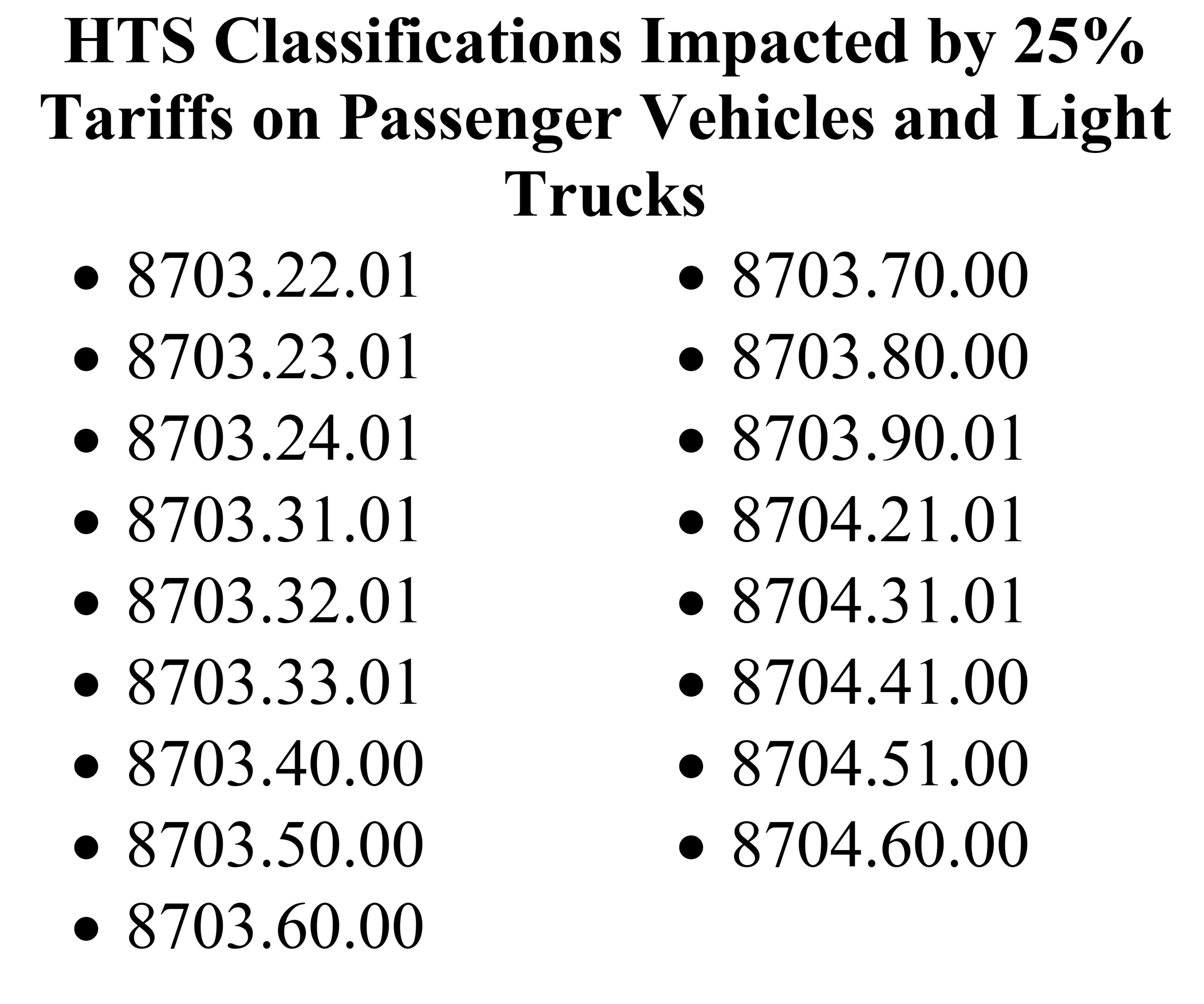

On or after 12:01 a.m. Eastern on April 3, the new 25% tariffs will apply to passenger vehicles (sedans, sport utility vehicles, crossover utility vehicles, minivans, and cargo vans) and light trucks classifiable in the following tariff provisions:

Vehicles that qualify for preferential treatment under the United States-Mexico-Canada Agreement (USMCA) may seek approval through a yet-to-be-established process under the Department of Commerce to certify their U.S. content and deduct that amount from the vehicle’s total value. Doing so would subject only the non-U.S. portion to the 25% tariffs. However, importers should double check their calculations when submitting such a claim, as U.S. Customs has been ordered to assess the 25% tariff on the vehicle’s full value if the agency identifies any overstatement of the U.S. content.

Vehicles manufactured at least 25 years prior to entry and those eligible for preferential tariff treatment under Chapter 98 will be exempt from the additional tariffs, unless classified under Subheading 9802.00.60 (the 25% tariffs would then apply to the full value of the imported article).

Auto Parts

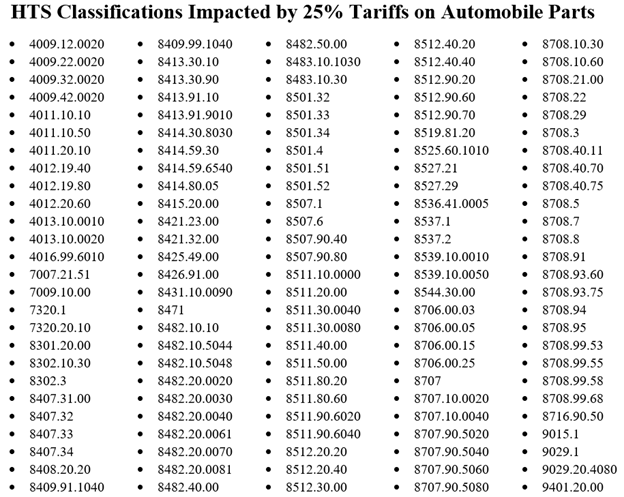

On or after 12:01 a.m. Eastern on May 3, the new 25% tariffs on automobile parts will take effect. The parts subject to the additional tariffs include engines and engine parts; transmissions and powertrain parts; electrical components; as well as other parts of passenger vehicles and light trucks classifiable under the following tariff provisions:

USMCA qualified automobile parts (other than knock-down kits or parts compilations) will be exempt from the tariffs until the Secretary of Commerce and CBP establish a procedure to apply the tariff exclusively to the value of the parts' non-U.S. content and publish a notice in the Federal Register. Within 90 days of Trump's initial Proclamation, the Secretary must also create a process for including additional auto parts within the scope of the tariffs, whether requested by domestic industry or the Secretary himself.

If your company would like to assess the additional tariff’s impact on your imports or would like to discuss strategies to mitigate their impact, please reach out to one of our attorneys at Barnes, Richardson & Colburn.