Industry News

Correction and Exclusions for ‘Reciprocal Tariffs' Published

TweetApr. 3, 2025

By:

Chaney A. Finn

Additional detail pertaining to President Trump’s April 2 Executive Order (EO) imposing “reciprocal tariffs” on U.S. trading partners has been provided within the EO itself. The President’s EO was updated with a revised country list (annex I), and a list of products excluded from the tariffs (annex II).

The revised country list (annex I) contains minor corrections from the initial list. The significant revisions were the removal of territories that are not independent (and thus export as part of the metropolitan country) and some of the uninhabited islands, such as the Heard and McDonald Islands which were initially subject to the 10% tariffs. The United States is presumably spared the ire of the local penguins.

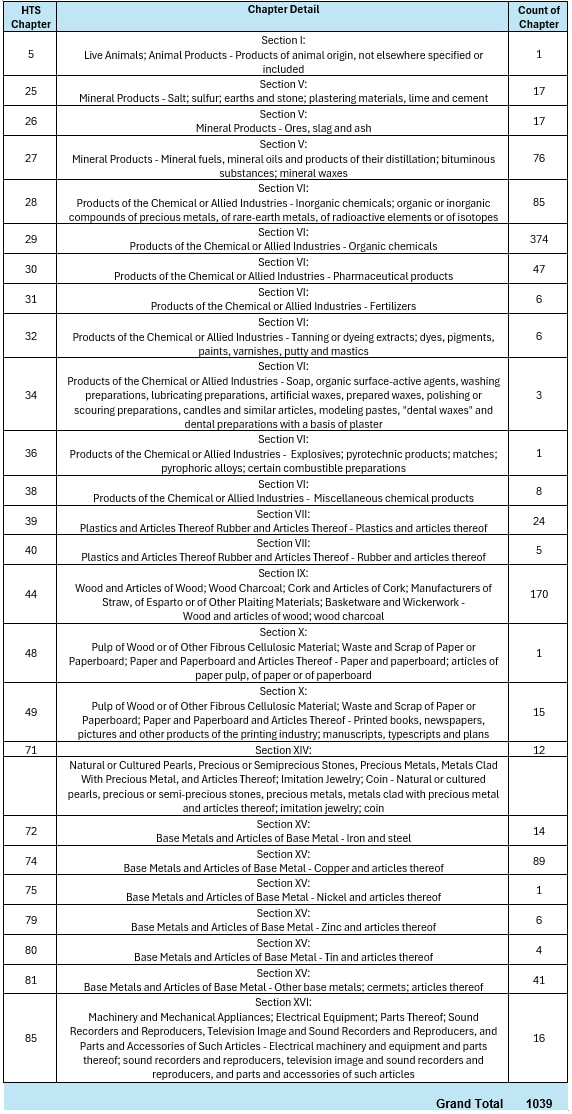

Products exempt (annex II) from the tariffs pertain to energy-related goods (coal, gas, oil, and electricity) chemicals, raw materials, and goods not otherwise produced in the U.S. In total, the list specified 1,039 HTS subheading lines across 25 Chapters, summarized in the table below:

As with any trade-related product identification list, exclusions from the “reciprocal tariffs” are product-specific. Meaning that not all products matching the HTS or description are within scope of the exclusion. The HTS and descriptions are for guidance purposes only and specific product language will be provided in (a not yet published) annex III pertaining to the scope of this order. Annex II refers any product questions be directed to Customs & Border Protection. Or you could inquire with any attorney at Barnes, Richardson, & Colburn to assist.

The annex II exemptions are in addition to the initial exclusions specified in the EO which include, (1) communications, donations, informational materials, and other related articles subject to 50 USC 1702(b); (2) steel/aluminum articles and autos/auto parts already subject to Section 232 tariffs; (3) copper, pharmaceuticals, semiconductors, and lumber articles; (4) all articles that may become subject to future Section 232 tariffs; (5) bullion; and (6) energy and other certain minerals that are not available in the United States.

The tariff rates and exclusions are subject to change, "should a trading partner retaliate, decrease tariffs, or ‘take significant steps to remedy non-reciprocal trade arrangements and align with the United States on economic and national security matters,’” as indicated by the Administration.

Should you have any questions regarding tariffs, or have any other trade-related questions, do not hesitate to contact any attorney at Barnes Richardson and Colburn.