Industry News

Reciprocal Tariffs Announced

TweetApr. 2, 2025

By:

Chaney A. Finn

President Trump issued an Executive Order implementing “reciprocal tariffs” on U.S. trading partners. By invoking authority under the International Emergency Economic Powers Act of 1977 (IEEPA), Trump introduced the tariffs to address “the national emergency posed by the large and persistent trade deficit.” The Trump Administration indicated that it intended these duties to counteract harmful tariff and non-tariff barriers such as value-added taxes, and other market distortions. Initial details on the measures are provided in a White House fact sheet.

Effective 12:01 a.m. eastern daylight time (EDT) on April 5, 2025, a 10% baseline tariff on imported goods from most countries, with exceptions detailed below, will be implemented. This baseline is in addition to regular duties and fees, current IEPPA duties, Section 201 duties, Section 301 duties, and any applicable AD/CVD.

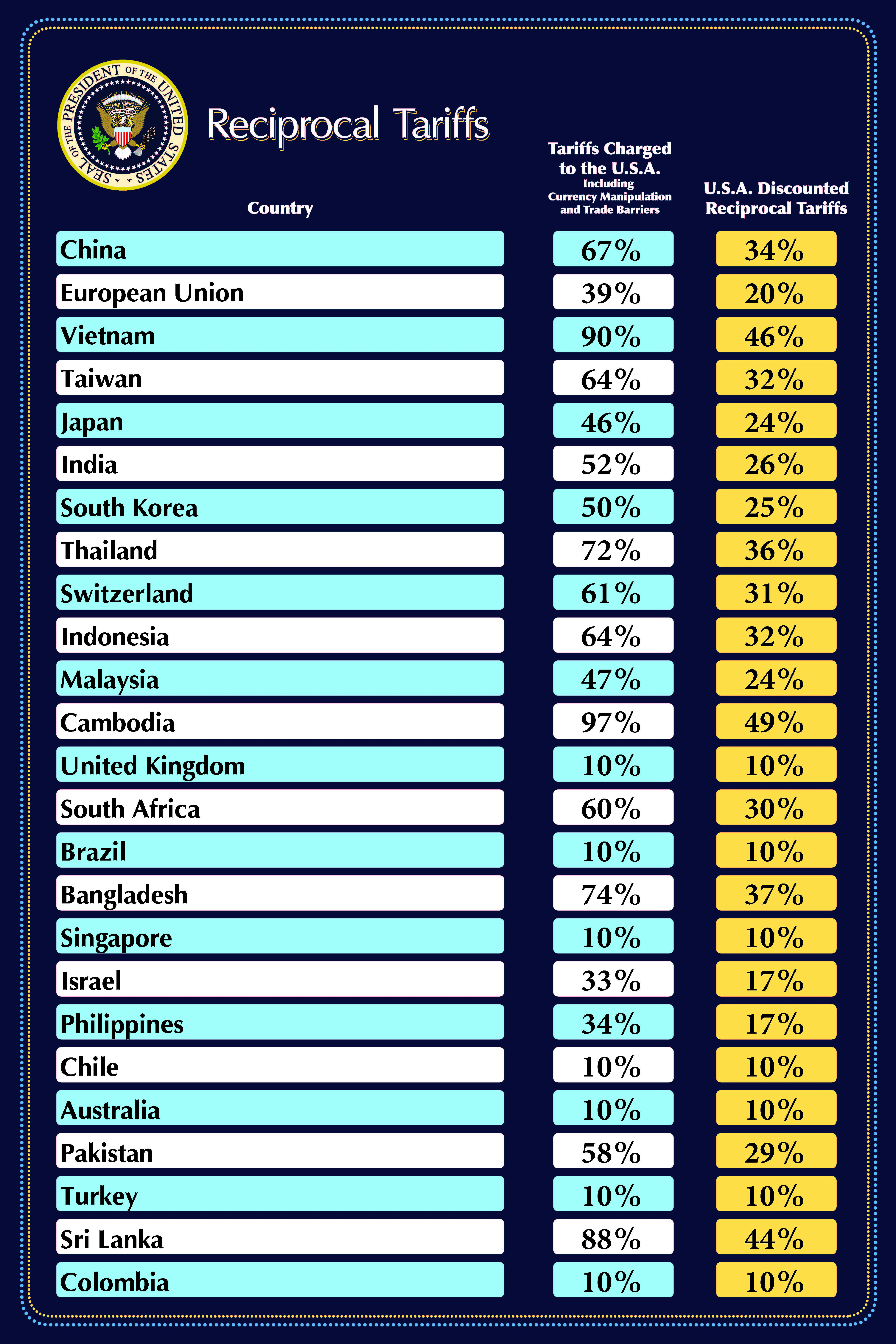

Effective 12:01 a.m. EDT April 9, 2025, country-specific tariffs will apply to goods imported into the U.S. In some cases these will remain 10% while in other cases they will be higher. See below for duty rates for some significant trade partners. These will remain in effect until Trump determines that the threat posed by the trade deficit and underlying nonreciprocal treatment is satisfied, resolved, or mitigated.

The full list can be found here.

The April 9, country-specific tariffs are similarly levied in addition to existing tariffs, with exception to the 10% baseline tariff implemented April 5.

Exclusions from the April 5 and April 9 tariffs include: (1) communications, donations, informational materials, and other related articles subject to 50 USC 1702(b); (2) steel/aluminum articles and autos/auto parts already subject to Section 232 tariffs; (3) copper, pharmaceuticals, semiconductors, and lumber articles; (4) all articles that may become subject to future Section 232 tariffs; (5) bullion; and (6) energy and other certain minerals that are not available in the United States.

Goods imported from Canada and Mexico were not subject to either the April 5 or April 9 tariffs. However, the existing fentanyl/migration IEEPA orders on Canada and Mexico remain in effect, and are unaffected by this order. USMCA-qualifying goods remain at 0% tariff, while non-USMCA compliant goods are subject to 25% tariff, and non-USMCA compliant energy and potash are set at a 10% tariff. Additionally, 25% tariffs on foreign-produced auto imports take effect April 3, 2025.

Russia and Cuba were also not specified for “reciprocal tariffs” but remain subject to Column 2 rates, in addition to other trade restrictions. Interestingly, the uninhabited Heard and McDonald Islands are also subject to a 10% tariff effective April 5. We do not expect this to substantially impact trade floes (sic).

The Administration indicates that “these tariffs are subject to change, should a trading partner retaliate, decrease tariffs, or ‘take significant steps to remedy non-reciprocal trade arrangements and align with the United States on economic and national security matters.’”

Should you have any questions regarding tariffs, or have any other trade-related questions, do not hesitate to contact any attorney at Barnes Richardson and Colburn.